Roth Ira Contribution Limits 2020 Married Filing Jointly

Then you can contribute.

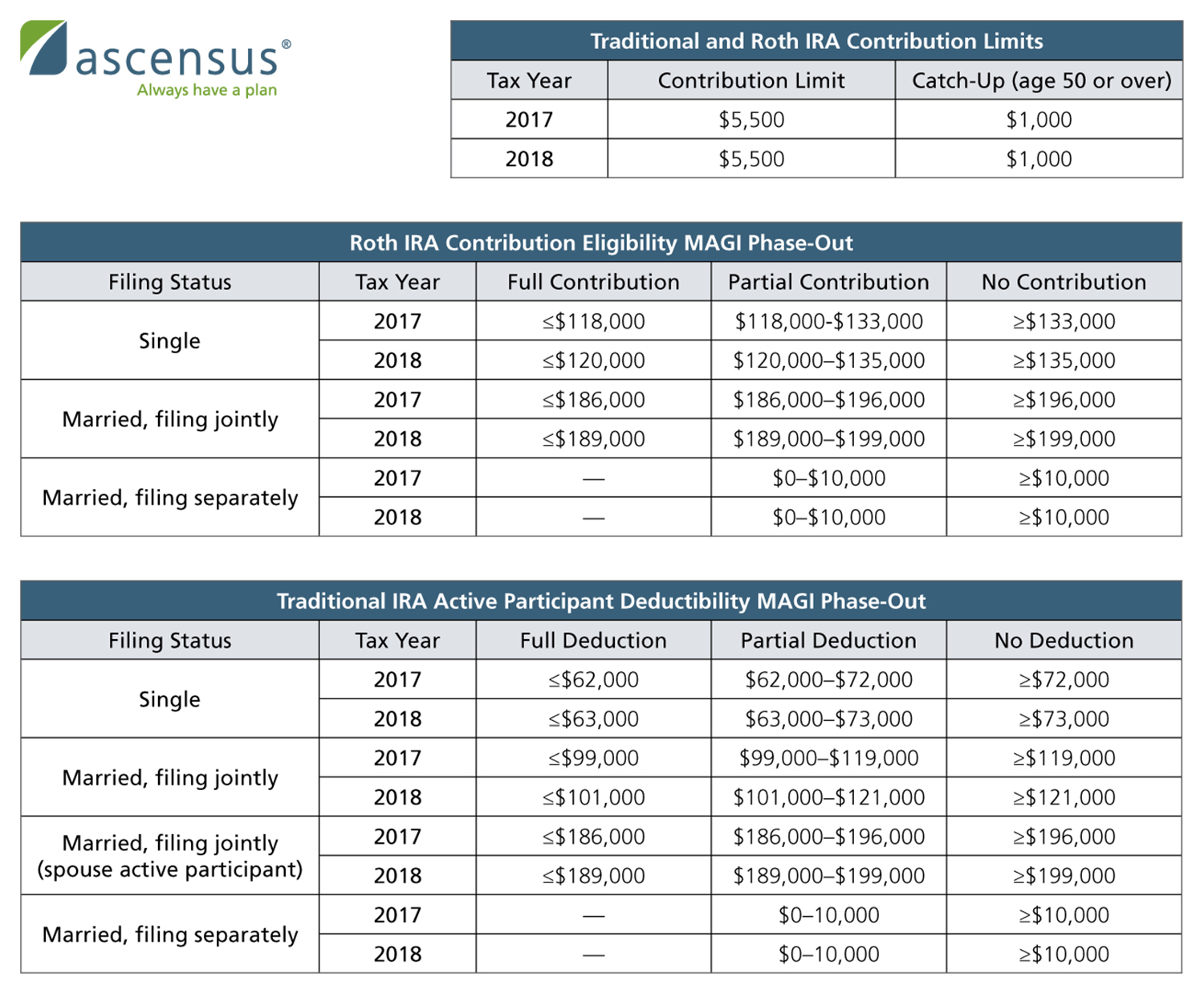

Roth ira contribution limits 2020 married filing jointly. For married couples with adjusted gross income of more than 194 000 no roth ira contribution at all is allowed. Married filing jointly or qualifying widow er 196 000. A reduced amount 206 000. Married filing jointly or qualifying widow er.

However one spouse can t contribute the entire amount to one ira. For roth ira contributions there s a maximum income limit. But there are restrictions that could impact how much you can contribute and what you can deduct on your tax return. Here s where the roth ira income limits stand for 2020.

A roth ira can be an excellent way to stash away money for your retirement years. Up to the limit 196 000 but 206 000. The 2019 roth and traditional ira contribution limit is 6 000 or 7 000 if you re age 50 or older. Multiply the maximum contribution limit before reduction by this adjustment and before reduction for any contributions to traditional iras by the result in 3.

Each spouse can continue to make contributions to his or her own ira. A reduced amount 10 000. For 2019 if you re 70 or older you can t make a regular contribution to a traditional ira. More than 196 000 but less than 206 000.

A full deduction up to the amount of your contribution limit. 2020 amount of roth ira contributions you can make for 2020. A full deduction up to the amount of your contribution limit. Like its traditional ira cousin this type of savings account allows your investments to grow tax free.

If you file taxes as a single person your modified adjusted gross income magi must be under 137 000 for the tax year 2019 and under 139 000 for the tax year 2020 to contribute to a roth ira and if you re married and filing jointly your magi must be under 203 000 for the tax year 2019 and 206 000 for the tax year 2020. And your modified agi is. Ira contributions after age 70. Between 184 000 and 194 000 a partial contribution is permissible.

However you can still contribute to a roth ira and make rollover contributions to a roth or traditional ira regardless of your age. Amount of roth ira contributions that you can make for 2017. Married filing jointly with a spouse who is covered by a plan at work. For example if the annual contribution limit is 6 000 each spouse can contribute 6 000 to that spouse s ira meaning the couple can contribute up to 12 000 for the year.

If your filing status is.