Roth Ira Contribution Limits 2020 Deadline

But there are restrictions that could impact how much you can contribute and what you can deduct on your tax return.

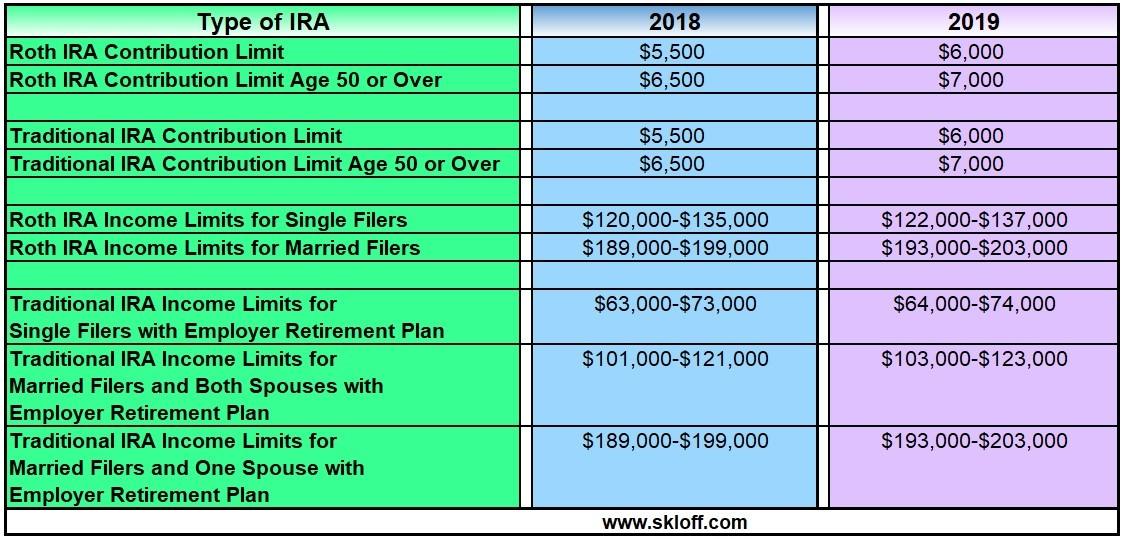

Roth ira contribution limits 2020 deadline. Subtract from the amount in 1. The roth ira contribution limit remains the same for 2020 as it was for 2019. For the 2019 tax year there is a 6 000 aggregate contribution limit for traditional and roth iras. 2019 amount of roth ira contributions you can make for 2019.

If you re under age 50 you can contribute up to 6 000 to an ira in 2020. Roth ira contribution limits. Ira contributions after age 70. How much can you invest.

The irs typically adjusts roth ira contribution and income limits every year. For 2020 the standard deduction amount is 24 800 for married couples filing jointly up from 24 400. The 2019 roth and traditional ira contribution limit is 6 000 or 7 000 if you re age 50 or older. Amount of your reduced roth ira contribution.

2019 roth ira contribution limits are 6 000 and must be made before april 15 2020. Contribution limits can change from year to year and are offset against traditional ira contributions. You should contribute directly to a roth ira and avoid the backdoor conversion if your magi is below a certain amount. However you can still contribute to a roth ira and make rollover contributions to a roth or traditional ira regardless of your age.

For single filers the amount is 12 400 up from 12 200 and for heads of households it s 18 650 up from 18 350. For 2019 if you re 70 or older you can t make a regular contribution to a traditional ira. 2020 amount of roth ira contributions you can make for 2020. Retirement savers 50 and older can contribute an extra amount.

If the amount you can contribute must be reduced figure your reduced contribution limit as follows. The 2020 tax year income limits are 124 000 for singles and 196 000 for. Roth ira limits for 2020. Roth ira contribution limits deadlines.

Start with your modified agi. Taxpayers who are 50 or over can make.