Roth Ira Basis Calculator

It is mainly intended for use by u s.

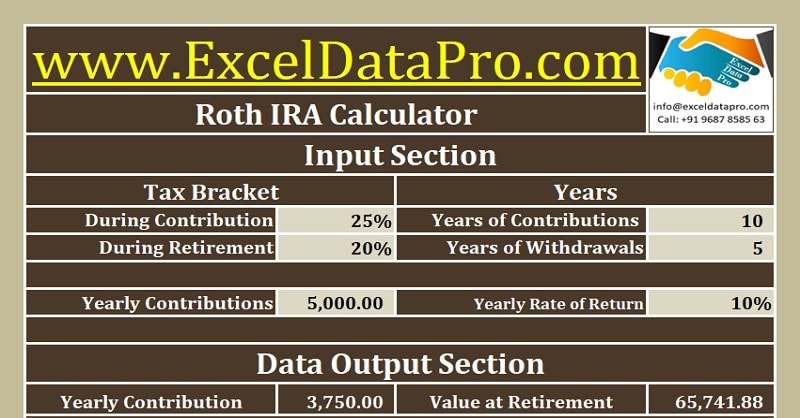

Roth ira basis calculator. Roth ira calculator calculate your earnings and more creating a roth ira can make a big difference in retirement savings. For instance if you expect your income level to be lower in a particular year but increase again in later years you can initiate a roth conversion to capitalize on the lower income tax year and then let that money grow tax free in your roth ira account. Calculating the basis for a roth ira conversion involves first establishing your basis prior to a conversion. Your roth ira contribution might be limited based on your filing status and income.

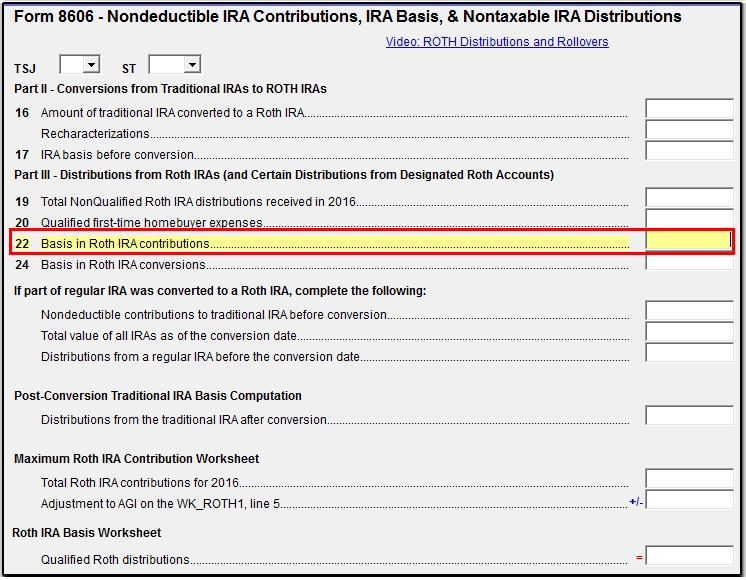

Most financial experts would agree that it is rarely if ever a good idea to take an early withdrawal from a traditional ira or roth ira this is due in part to the high cost of penalties that can. 2019 amount of roth ira contributions you can make for. Roth contributions are not tax deductible so you ve already paid taxes on the money. The term basis is sometimes used to refer to the amount of contributed funds in a roth ira.

Use this roth ira calculator to determine your contribution limit for the 2019 tax year. The overall percentage of your account that represents your basis will be the same percentage figure you use to calculate the portion of the conversion that is the converted basis. Use this roth ira calculator to determine your contribution limit for the 2019 tax year. Limits on roth ira contributions based on modified agi.

Roth vs traditional ira. The roth ira calculator defaults to a 6 rate of return which should be adjusted to reflect the expected annual return of your investments. 2020 amount of roth ira contributions you can make for 2020. The same combined contribution limit applies to all of your roth and traditional iras.

The roth conversion calculator rcc is designed to help investors understand the key considerations in evaluating the conversion of one or more non roth ira s i e traditional rollover sep and or simple iras into a roth ira but it is intended solely for educational purposes it is not designed to provide tax advice and the list of factors included in the calculation is not exhaustive. For calculations or more information concerning other types of iras please visit our ira calculator. Roth ira calculator this is a fixed rate calculator that calculates the balances of roth ira savings and compares them with regular taxable savings.