Roth Conversion Ladder Limit

If you re going to use a roth ira conversion ladder to fund your early retirement years you have to make sure there ll be plenty of retirement assets left by the time you reach 59.

Roth conversion ladder limit. The total non roth ira balance is 280 000. Then move the money into a roth ira using a roth conversion. Remember the roth conversion ladder is like a plant it takes time grow. The roth ira conversion ladder works starts with you rolling over your 401 k into a traditional ira once you leave your job.

The amount of the conversion that won t be subject to income tax is 14 29. A conversion to a roth ira results in taxation of any untaxed amounts in the traditional ira. The rest will be. The total amount that is desired to be converted is 140 000.

A roth ira conversion is a movement of assets from a traditional sep or simple ira to a roth ira which is a taxable event. Based on the numbers above we have 40 000 total after tax contributions to non roth ira s. So far so good no taxes or penalties to worry about. The conversion is reported on form 8606 nondeductible iras.

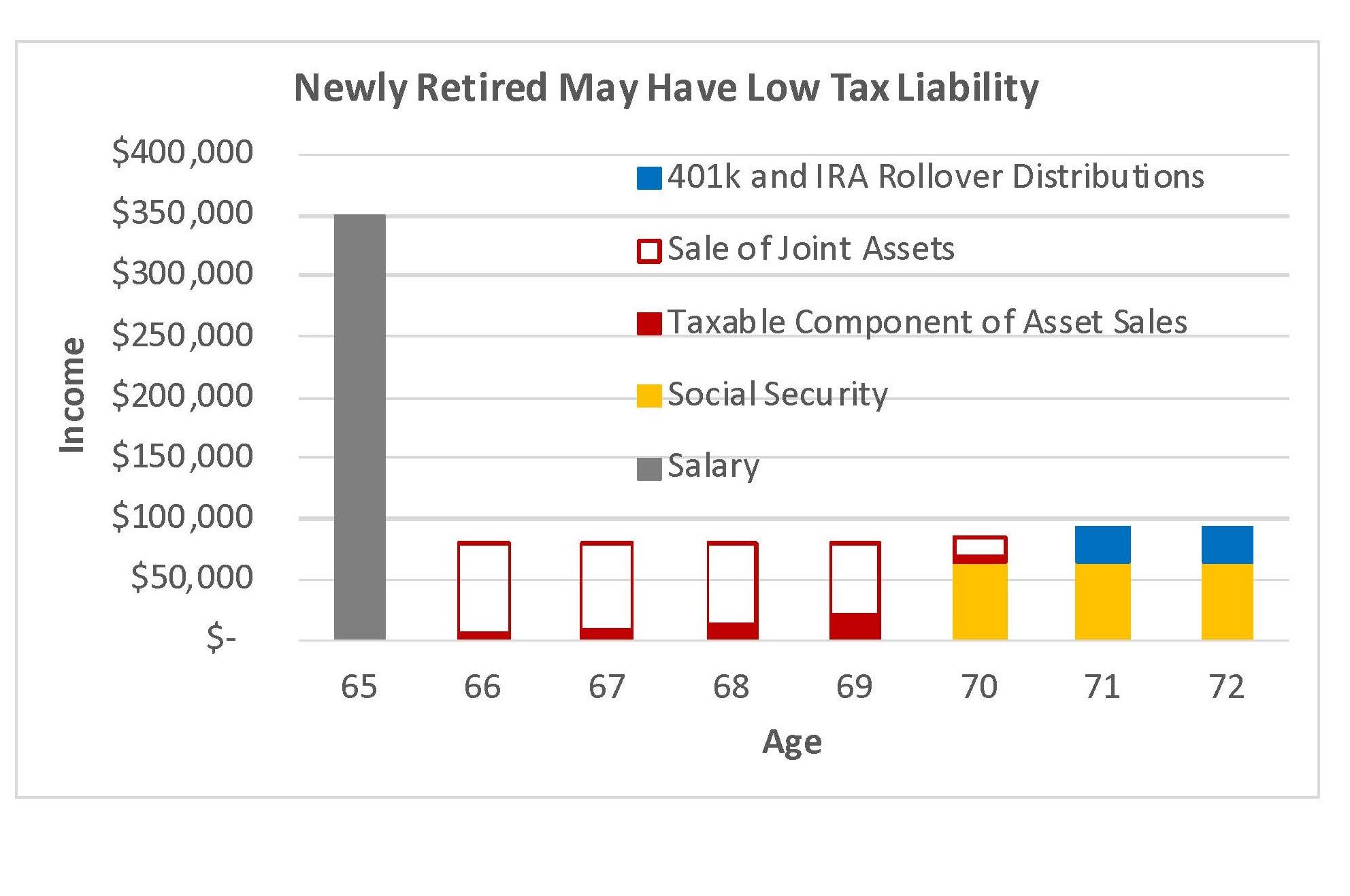

See publication 590 a contributions to individual retirement arrangements iras for more information. In the example above the total amount of retirement capital used for the roth ira conversion ladder is 400 000. Ignoring other income a single person climbing the roth ira conversion ladder will pay 3 213 in federal income tax each year to keep the ladder going. For example if you plan to retire at 45 and you think you ll need 50 000 per year to live you should do a roth ira conversion for that amount at age 40.

Withdrawals of money from a conversion of a traditional ira or 401 k to a roth ira will be subject to a 10 penalty tax if the withdrawal occurs within five years of the conversion. Here s where things get a little trickier though. The conversion would be part of a 2 step process often referred to as a backdoor strategy. You will then have to do a roth ira conversion for at least 50 000 each year up until age 54.

But make sure you understand the tax consequences before using this strategy. So you want to convert 40 000 inflation adjusted per year from your traditional ira to your roth ira. Once that s done you move your money into a roth ira. That s the tax due on a 34 800 ira conversion.

That will cover you through age 59.