Brentwood Mo Sales Tax 2020

The brentwood sales tax is collected by the merchant on all qualifying sales made within brentwood.

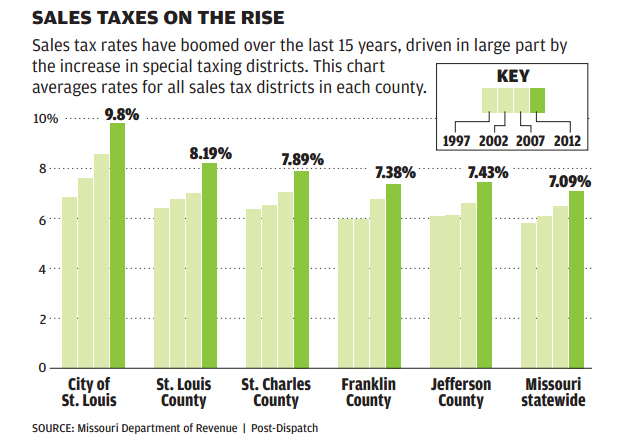

Brentwood mo sales tax 2020. The december 2019 total local sales tax rate was 9 113. The missouri department of revenue administers missouri s business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax financial institutions tax corporation income tax and corporation franchise tax. Indicates required field. The missouri sales tax rate is currently.

The minimum combined 2020 sales tax rate for brentwood missouri is. Mo gov state of missouri. The minimum combined 2020 sales tax rate for saint louis missouri is. Use tax does not apply if the purchase is from a missouri retailer and subject to missouri sales tax.

Review of bylaws 5. The missouri sales tax rate is currently. Brentwood collects a 4 888 local sales tax the maximum local sales tax allowed under missouri law. The board of aldermen approved the collection of this tax which will begin january 1 2020.

The current total local sales tax rate in brentwood mo is 9 738. City of brentwood economic development sales tax board brentwood firehouse 1st floor conference room 8756 eulalie avenue brentwood mo 63144 february 27 2020 6 00 pm agenda 1. Brentwood voters approved proposition b an economic development sales tax in april 2019 by a 3 to 1 margin. This is the total of state county and city sales tax rates.

Unlike sales tax which requires a sale at retail in missouri use tax is imposed directly upon the person that stores uses or consumes tangible personal property in missouri. Call to order and roll call 2. This is the total of state county and city sales tax rates. Vote on officers 6.

Brentwood bound project. Find sales and use tax rates enter your street address and city or zip code to view the sales and use tax rate information for your address. This is the total of state county and city sales tax rates. Agenda approval approval or amendment of agenda 3.